Budgeting like Theresa

Команда iSavta | 13.11.2019

The word Budgeting is as frequently used as dieting. Easy to say, painful to do.

We diet after the new year, create a budget every payday and the rest of the days forget about it.

Budgeting isn’t about depriving oneself of enjoying life. It is finding a balance to properly allocate personal funds.

Wealthy people are good budgeters. It is said gold attracts gold. The rich are becoming richer and the poor just go poorer.

It makes sense because the wealthy knows how to protect and increase their money while most of the poor complain and spend.

Do you think budgeting is miserable because you deny yourself gratification?

Does having money gives you self confidence or satisfaction?

Do you practice “YOLO (You only live once)” with regards to spending?

As employees we receive a monthly paycheck. How do we treat our paycheck?

Let me tell you the story of Theresa who is now more than 6 years in Israel. She has 4 kids and a single mother. 3 teenagers are not easy to manage from afar and her last kid needs to be monitored for asthma. You’d think she is financially hanging by her fingernails. You’ll be surprised.

One of the things that she emphasized is she keeps her family circle a tight family circle. She extends financial help to other family members only up to a point, no more.

In short, she does not play “Lady Bountiful”.

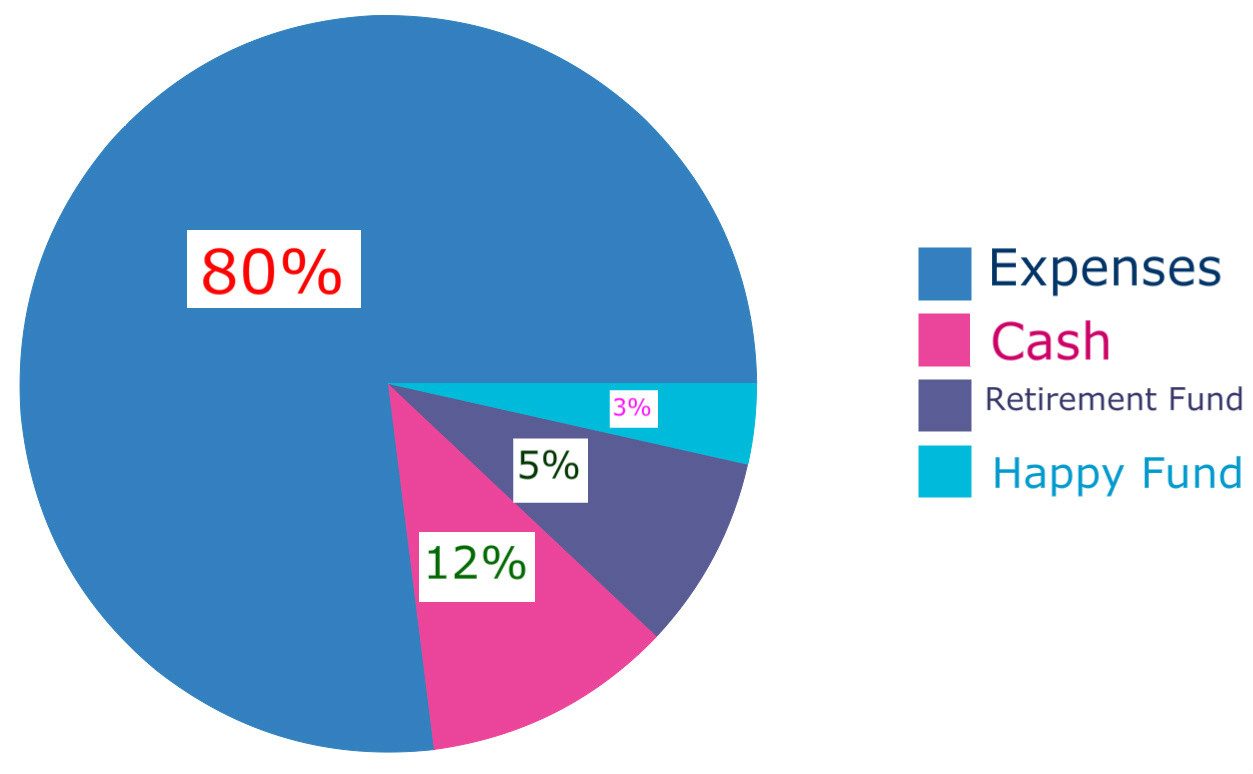

This is the breakdown of Theresa's paycheck.

|

80% Expenses |

12% Cash |

5% Retirement Fund |

3% Happy Fund |

|

Bills Groceries Future Tuition Fees Other crucial fees like Philhealth Social Security Services |

Emergency Fund. Savings account. -Funds that are available anytime. |

Investment in paper assets thru banks. |

Travel Fund Shopping Fund Eating out Personal expenses |

Expenses

The biggest expense is food and tuition fees. She has 3 growing teenagers!

On the expenses side, her children's future college tuition fees is treated as an expense and is saved individually for each of her children. It could earn more if she invest it in a money market fund but she doesn’t want any risk and she has her valid reasons.

Typically Social Security System and PhilHealth are not under expense but Theresa reasoned that it’s not generating money for now.

Cash and Emergency Fund

She has experienced what it feels not to have any money in her pocket in an emergency. Her cash reserves is enough for her in case she has to go home for good.

Retirement Fund

It’s still a very new concept for her about this “investing” concept. The good thing about it is she is embracing the idea that she went to her bank, BPI, and ask what kind of financial products they offer that will suit her.

Ideally, the retirement fund should be higher but this is Theresa’s plan. It is possible that she will increase her investment fund when she fully grasp how it works.

Happy Fund

What makes budgeting boring is that it implies denial. But there is a big difference between spending wisely and spending unceasingly.

Teresa isn’t depriving herself. She has her happy fund! Go for quality rather than quantity.

Every month is not perfect, some months the expenses ate some of her cash budget but she always manage to go back to her budget. She does not give up on her budget. That’s the secret.

Her 3 keys that serves as the foundation of her budgeting plans.

Attitude: She developed an attitude of looking forward to payday because it means one more achieved step up. Initially her bitterness towards the father of her children consumes her energy. Now, her energy is focused on looking forward with a positive stance.

Budgeting should not be miserable. Enjoy it.

Family Involvement: She sets herself as an example to her kids. She sets a monthly allowances to all her kids and they too has happy funds set aside.

The happy fund is the key of removing that feeling of depriving oneself. It is also a lesson of discipline.

Commitment: It’s not a perfect budget all the time. There are months that the budget is stretched to the limit. Months that simply feels like the gods are heaping down curses on her head and the budget is shot. Months that passed calmly. All through these trials, she does not entertain the thought of throwing out her budget plans.

Her budget is hers and her needs are different from everyone of us. She still has a long way to go to be really financially stable. Make a budget that clearly defines the result that you want.

“Where the determination is, the way can be found.” ― George S. Clason, The Richest Man in Babylon.

Related: Save money on remitПодробнее о Money & Investments

Money & Investments