Pension and Deductions: For Your Information

iSavta | 22.07.2022

For your information, please read this article.

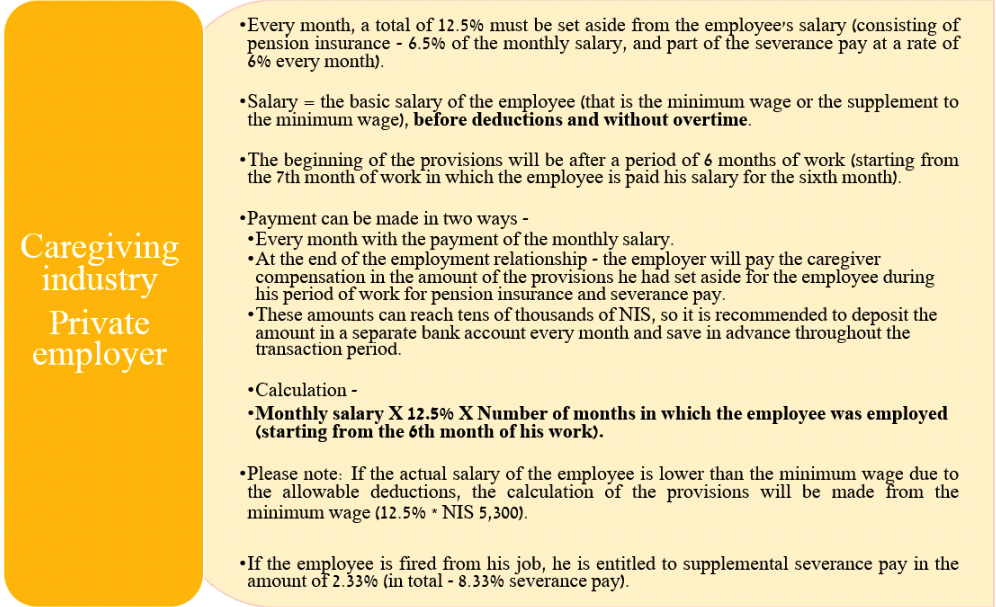

• Every month, contributions to the pension program must be made, at the moment, in the amount of 12.5% of the salary (the interest rate consists of 6.5% pension insurance and 6% retirement benefit.

• Wage = basic salary of the employee (t. well. minimum wage or minimum wage allowance) before deductions and excluding overtime

•Deductions begin after 6 months of work (that is, from 7 months of work, after paying 6 salaries)

• Two ways can be calculated:

- Monthly salary with official stamping.

-After the end of employment - the employer pays the employee compensation in the number of deductions, which he should have set aside for the employee during his work period for pension insurance and retirement benefits.

-In any case, it is recommended to deposit a sum to a separate bank account every month.

• An example of the calculation:

Monthly wage * 12.5% * Number of months during which the employee was employed (starting from the 6th month of his slave

Fire).

• Note: if the employee's actual salary is lower than the minimum wage due to deductions, deductions will be calculated from the minimum wage (t. well. - 12.5% * 5,300 shekels). These amounts can reach tens of thousands of shekels, so it is recommended to set aside these amounts in advance and throughout the period of employment.

•Employers in Israel are required to offer pension insurance to their workers. This obligation also applies to employers who hire foreign workers. The "approximate rule of implementation" refers to pension insurance provisions for foreign caregivers from private employers. We have prepared guidelines for you.

Подробнее о Money & Investments

Money & Investments